Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

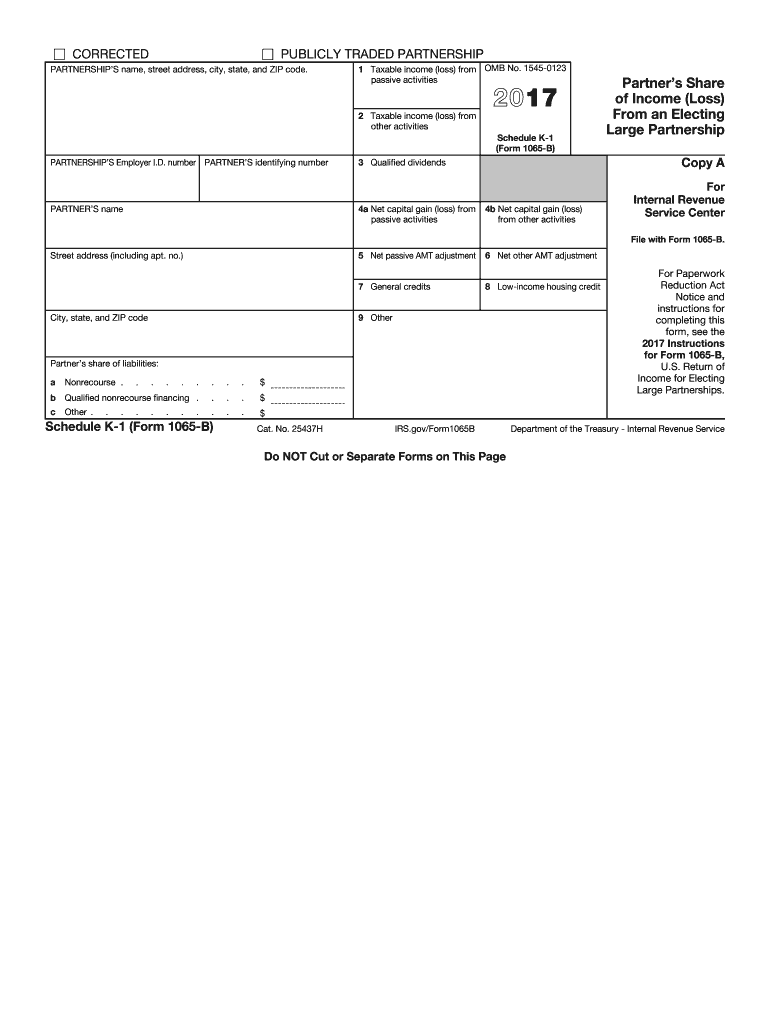

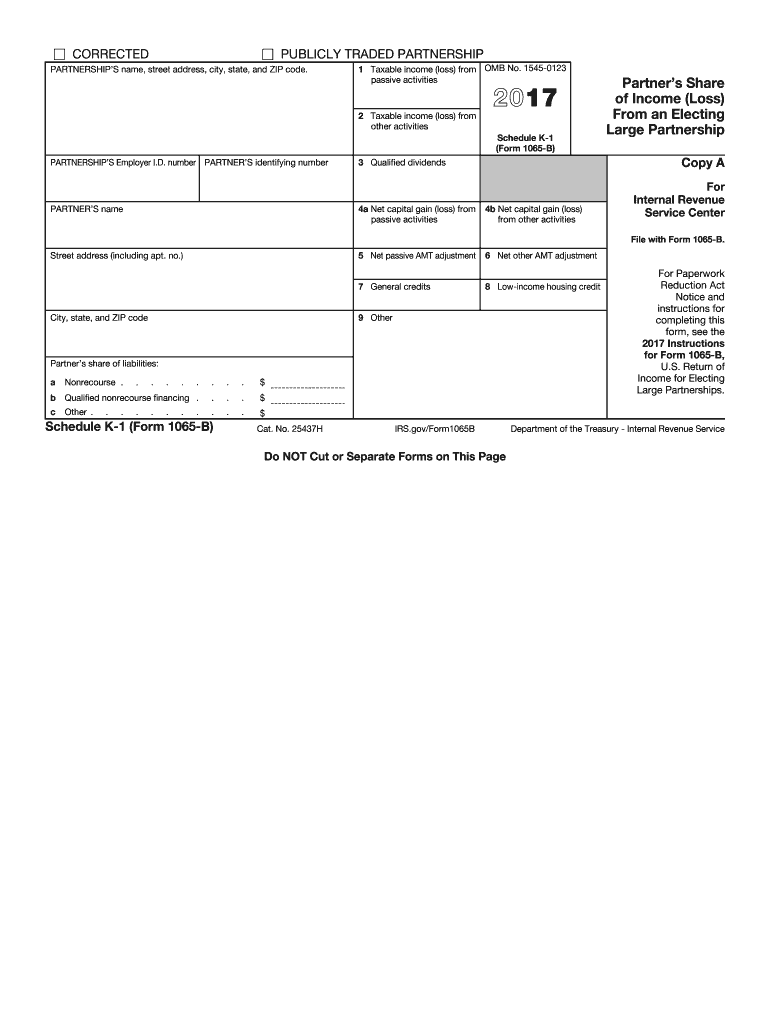

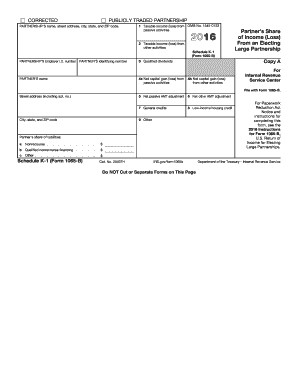

How to fill out irs k 1 form?

1. Enter the name of the partnership.

2. Enter the partnership’s Employer Identification Number (EIN).

3. Enter the address of the partnership.

4. Enter the tax year of the partnership.

5. Enter the name of the partner.

6. Enter the partner’s Social Security Number (SSN).

7. Enter the partner’s address.

8. Enter the partner’s tax classification.

9. Enter the partner’s share of the income, deductions, credits, and other items.

10. Enter the amount of partner’s distributive share of the partnership’s items.

11. Enter the partner’s allocable share of the partnership’s deductions, credits, and other items.

12. Enter the partner’s share of the partnership’s liabilities.

13. Sign the form and submit it to the IRS.

What is the penalty for the late filing of irs k 1 form?

The penalty for the late filing of an IRS K-1 form is normally 5% of the total amount owed for each month the form is late, with a maximum penalty of 25% of the amount owed. In addition, the IRS may also charge interest and other penalties.

The IRS K-1 form is a tax form used by partners in partnerships, shareholders in S corporations, and beneficiaries of certain trusts to report their share of the income, deductions, credits, and other information from these entities. It is used to determine the individual's tax liability and is filed with the individual's personal tax return (Form 1040).

Who is required to file irs k 1 form?

The IRS K-1 form, officially known as Schedule K-1, is used by partnerships, S corporations, and some other types of pass-through entities to report income, deductions, and credits to their partners or shareholders. Therefore, the partners or shareholders of these entities are required to file the IRS K-1 form.

What is the purpose of irs k 1 form?

The purpose of the IRS K-1 form is to report the individual partner's share of income, deductions, and credits from a partnership, S corporation, estate, or trust. It is used to report the partner's or shareholder's share of the entity's profits or losses for the year, which they must report on their individual tax returns. The K-1 form provides detailed information about the allocated amounts of income, deductions, and credits, allowing the recipients to accurately report their share of the entity's tax attributes.

What information must be reported on irs k 1 form?

The IRS K-1 form, also known as Form 1065 Schedule K-1, is used by partnerships and S corporations to report a partner or shareholder's share of income, deductions, credits, and other items. The form includes various sections that need to be reported, including:

1. General information: This section requires the identification of the partnership or S corporation, as well as the partner or shareholder receiving the K-1.

2. Income and expenses: This section reports the partner or shareholder's share of taxable income or loss from the partnership or S corporation. It includes items such as ordinary business income, interest, dividends, capital gains, rental income, and expenses related to the business.

3. Schedules: Certain items may require separate schedules, such as foreign transactions, alternative minimum tax, self-employment tax, and passive activities.

4. Tax credits: This section reports any tax credits allocated to the partner or shareholder. Common credits include the general business credit, energy credits, and rehabilitation credits.

5. Other information: Additional information may include the partner or shareholder's share of charitable contributions, Section 179 expense deductions, and information related to foreign activities or investments.

It is important to note that the specific items reported on the K-1 form may vary depending on the partnership or S corporation's activities and business structure.

When is the deadline to file irs k 1 form in 2023?

The specific deadline for filing IRS Schedule K-1 for tax year 2022 (not 2023) depends on the type of entity issuing the K-1:

1. Partnership: Partnerships (including Limited Liability Companies taxed as partnerships) must file Form 1065 by March 15, 2023. The K-1 forms are then provided to the partners by this filing date.

2. S Corporation: S Corporations must file Form 1120S by March 15, 2023. The K-1 forms are then provided to the shareholders by this filing date.

It's important to note that partners and shareholders must receive their K-1 forms before the due date for filing their personal tax returns, which is typically April 15th. If you are a recipient of a K-1 form, make sure to give the entity enough time to prepare and distribute the forms to you before this deadline.

How can I send irs k 1 form to be eSigned by others?

Once your k 1 1065 b form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit k1 form taxes online?

The editing procedure is simple with pdfFiller. Open your k 1 1065b partnership print in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the taxable capital gain in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your capital gain form.