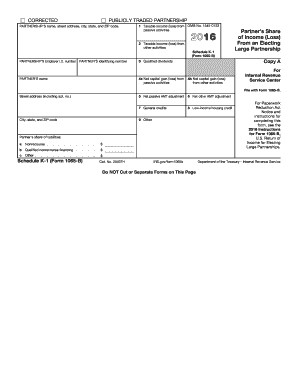

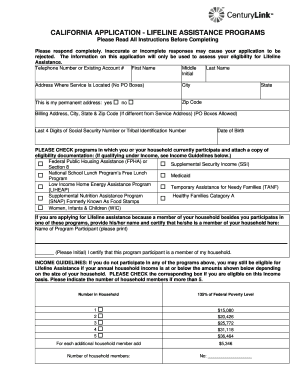

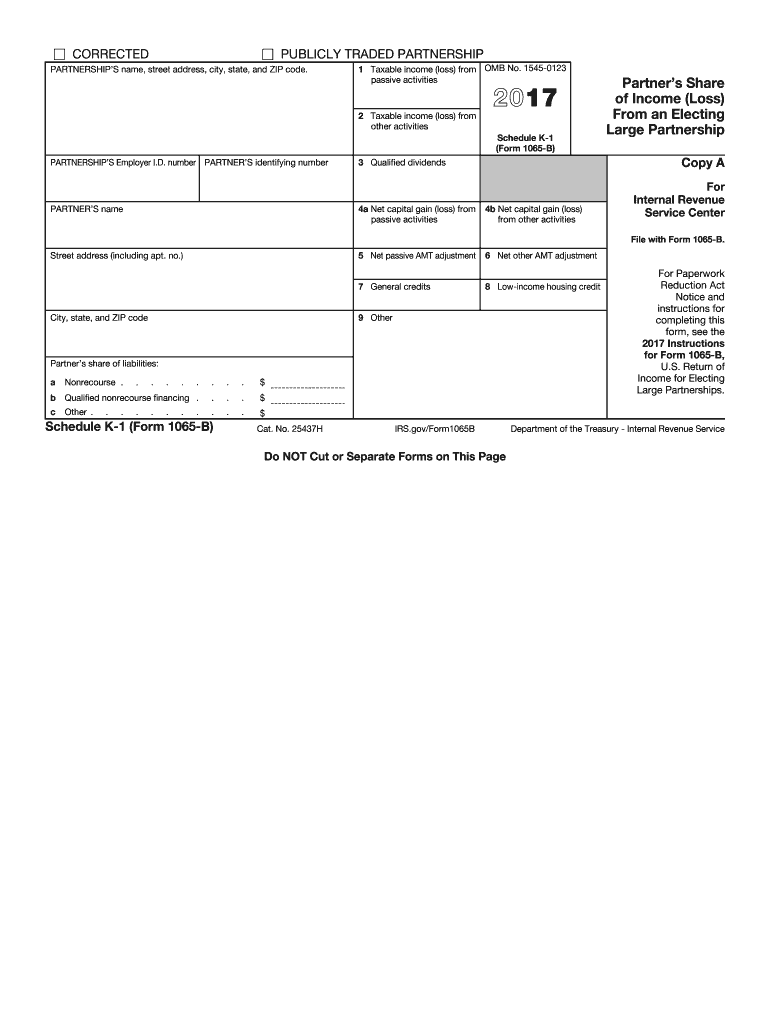

IRS Schedule K-1 (1065-B) 2017-2026 free printable template

Instructions and Help about IRS Schedule K-1 1065-B

How to edit IRS Schedule K-1 1065-B

How to fill out IRS Schedule K-1 1065-B

Latest updates to IRS Schedule K-1 1065-B

All You Need to Know About IRS Schedule K-1 1065-B

What is IRS Schedule K-1 1065-B?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS Schedule K-1 1065-B

What should I do if I realize I've made a mistake on my IRS Schedule K-1 1065-B after submission?

If you discover an error after submitting your IRS Schedule K-1 1065-B, you need to file an amended return using Form 1065-X, which allows you to correct mistakes. Make sure to clearly mark it as an amended return and provide an explanation of the changes. Submitting corrections promptly ensures compliance and avoids potential penalties.

How can I confirm if my IRS Schedule K-1 1065-B has been received and processed?

To verify if the IRS Schedule K-1 1065-B has been processed, you can call the IRS or check your e-filing status through their online portal. Keep in mind that processing times can vary, so it might take several weeks depending on the volume of returns the IRS is handling at the time.

Are there any special considerations for filing an IRS Schedule K-1 1065-B for a nonresident payee?

When filing for a nonresident payee, ensure that the IRS Schedule K-1 1065-B complies with any additional requirements specific to foreign individuals. This might include withholding taxes or special reporting under FATCA. Consulting with a tax professional familiar with international tax law can help ensure proper compliance.

What should I do if I receive an audit notice related to my IRS Schedule K-1 1065-B?

If you receive an audit notice regarding your IRS Schedule K-1 1065-B, read the notice carefully to understand what information the IRS requires. Gather relevant documentation that supports your filing, including any amendments made, and consider seeking help from a tax professional to navigate the audit process effectively.